Doing your accounting with software, whether your data is stored on your computer or in the clouds, is mandatory in today’s business world. The only problem is that this software could cost a fortune and often lacks some features you need to manage your business — or, quite the contrary, they are full of features you don’t need. So it is not surprising that many business owners are looking for free or at least affordable alternatives. Well, you are lucky, because in this article we are going to talk about such alternatives. We’ll be taking a look at three possible options: free online accounting solutions, open source accounting software and the free trials offered by the premium companies.

Free Online Accounting Software

The problem with some paid online accounting solutions that could be used for a monthly/annual subscription fee is that they are either cheap but have the basic features only, or they have every possible feature but for a hefty price. You might be asking: are there completely free of charge online accounting solutions that have all the features you need and are (possibly) not filled with annoying third-party ads? The answer is yes, there are: free online accounting solutions.

The efficient management of a business requires the use of proper software tools and strategies. If you need a certain tool or software that can help you manage accounts and help in the growth of your business, then the Business Accounting Software tool is the best one for you. Some of the best free accounting software tools and their main features are mentioned here in this article. Mint is a free online budget planner from Intuit, the makers of TurboTax. Best 5 Accounting Software for Mac. For small and medium sized businesses or personal users that are seeking a seamless solution for their payment, invoicing and payroll management needs, FreshBooks is one of the best and simplest solutions. This accounting software package is suitable both for on-premises accounting applications.

These software are intended for small proprietors, contractors and small businesses who only want to get the basic features. Most of the time, free accounting solutions do provide just those features like invoicing, client management, banking, expense tracking, and building business reports. Some companies add features that are not present in paid accounting solutions either, like multi-currency, estimating and the fast online payment options for your customers. And we haven’t even mentioned the mobile applications coming in the free package or the possibility of integrating the accounting solution with third-party apps, thus creating the perfect virtual assistant without paying a single dime. All of this for free! So where is the trick?

| Rank | Provider | Info | Visit |

| Editor's Choice 2021 |

| ||

| |||

|

The trick is that some features you need are either available for a subscription fee, thus you have to say goodbye to the free software, or they are not available at all to keep costs for the provider as low as possible.

4.5 (152) A fund accounting platform made with church. The software also lets you view your budgets by a variety of time periods (monthly, annually, and so on). It also provides tools to help automate your data entry. Setting goals, such as.

Now let us show you two examples on how this business model works with the help of Wave Accounting and Brightbook:

Wave Accounting

Creating Invoices in Wave Accounting

Capturing Receipts with the Wave App

Canada-based Wave Accounting is particularly intended for businesses with 9 employees or less with its simple, yet user-friendly design. It has basic accounting features like unlimited clients and users, (recurring, multi-currency) invoices, estimates and bills, reports, and receipt processing, but it has an inventory and payroll feature, too. The number of third-party apps that could be integrated into Wave is only three. Despite having a quick and handy mobile app that handles invoices, payments, payroll and receipts, only the latter feature is available for Android; the others can be found in the iOS app. And now some words about the additional costs: the software is free of charge, chat support costs $9 per month, adding phone support to the mix is $19 per month, payroll is $14 per month plus $4 per each employee, while the fast payment option costs 2.9% + $0.30 per transaction.

Brightbook

Invoicing in Brightbook

Profit & Loss Report in Brightbook

UK-based Brightbook is also a good alternative to the paid online accounting solutions for sole proprietors, contractors, startups, freelancers and small businesses. It is a very basic solution, but it has everything you need: access for unlimited users (including co-workers, clients and accountants), invoicing in different currencies, quotes that could be easily turned into invoices, expense tracking and recording, bank statement processing, auto-generated profit & loss and aged debtor reports, a fast PayPal option for your clients, and even a so-called paranoid login which randomly chooses a password from a list each time before you access your account. Unfortunately there are many cons of Brightbook: the solution cannot be accessed from a mobile device neither from a mobile browser, nor an app. The software doesn’t integrate with any other third-party solution, and the only additional features you can subscribe to are branding your invoices and statements and designing your templates.

Open Source Online Accounting Solutions

Another option to “go free” is choosing open source software like GnuCash and TurboCASH. While you only borrow a paid online accounting solution, an open source version can actually be downloaded for free for any platform available, thus these solutions are ideal for small and medium-sized businesses looking for saving as much as possible. Most of the time, open source accounting solutions have all the major features you need to run a business like invoicing, reports, taxes, inventory etc. and they are usually available in over 20 multiple languages, a feature paid software never have. These solutions also offer a great community experience: it is a good way to get information about the software itself, plus as they are in continuous development, user feedback is a perfect way to get you and fellow business owners involved in making the solutions better.

There are some disadvantages, though. The biggest issue with open source software, aside from not having mobile apps and being incapable of integrating with third-party software, is that they are usually developed for risk-takers. Due to the continuous development, the solutions will never be 100% perfect, there is no official customer support, but if there is – like in the format of a user guide or Skype-call by experts – it is usually available for an additional fee. And, once in a while, it is highly recommended to donate a certain amount of money to the developers to help them continue developing the software.

GnuCash

Basics of GnuCash

Development of GnuCash began in 1997 and since then it has become a perfect alternative for QuickBooks and Quicken, two of Intuit Inc.’s products. This software is available in 21 languages and can be downloaded to any platforms from Windows to Mac and Linux. GnuCash has many features your business (probably) needs including: accounts receivable and payable, invoicing, investment accounts, bank, credit and loan accounts, tax statements, reporting, graphs, multiple currencies, depreciation, scheduled transactions, importing QuickBooks files, and even online stock management. If you need any help, GnuCash offers you the following support options: a help manual, a tutorial and concept guide, a Wiki page, FAQ, email and chat. However, there is a catch: GnuCash uses double entry accounting, so if your business is using a different accounting system, you have to look for another software.

TurboCASH

Document Management in TurboCASH

Reports in TurboCASH

According to the company, TurboCASH has over 100,000 clients worldwide. Despite having over 23 languages, which beats GnuCash, the software is only available for Windows. However, it is still a worthy competitor of paid desktop programs like QuickBooks Pro, with a clean, attractive, easy-to-use user interface through which you will find features like invoicing, reporting, inventory and stock pricing, quotes, trial balances, batch operations, and multi-user and access controls. It also supports projecting and provides continuous backups of your data. Since 2016, the company has a business edition called TurboCASH Business Class with extra features like a Windows 10-style appearance, online bank import, user manuals, advanced reporting templates, spreadsheet features etc. However, this version is not for free: it costs $50. Furthermore, if you need advanced help, you also have to pay: a detailed user manual is $25, 1 hour of Skype-support is $50, while professional help can cost up to $450.

Mac Business Accounting Software

Free Trials for Online Accounting Software

Last, but not least, there is the most obvious solution to have online accounting software for free: the free trials of the premium accounting solutions. Free trials are essential for accounting companies, because they are like business cards: they have to convince their potential new client that their services and prices are the best in the accounting market. Therefore these free trials allow new users to try out the top product of the company for a limited amount of time.

This unlimited access to all features is a huge advantage, because you can get to know the software and the company. When you decide to purchase the software, you will already know which features you will need in the future and which ones are unnecessary. A further advantage is that after subscription you can continue using the software for free until the expiration of the trial period or you can just terminate your account. And upon request, you can extend the trial for a limited time, if you need more time to think.

Unfortunately, there are some downsides: typically a free trial only lasts for 14–30 days tops, after which you are forced to subscribe. Furthermore, if you want all features, you have to subscribe to the top product of the company, which usually costs around $40 per month — without the additional paid features such as payroll and fast payment.

Now, without further ado, let us recommend some outstanding premium accounting solutions: Xero, FreshBooks and Sage One.

Xero

User Management in Xero

Capturing Receipts in Xero Touch

Xero, which offers three pricing packages, has the biggest amount of available features during the 30-day free trial period: unlimited users, invoicing, billing, expenses, quoting, estimating, preparing and filing your 1099s and W-2s, and the extra payroll feature. The software has an iOS and Android app, which can serve as a second step in the optional two-step authentication process, and it integrates with over 400 different software. Also, you get unlimited access to the 24/7 customer service, the help center, and the regularly organized webinars.

FreshBooks

Projects and Time Tracking in FreshBooks

Managing Contacts in FreshBooks

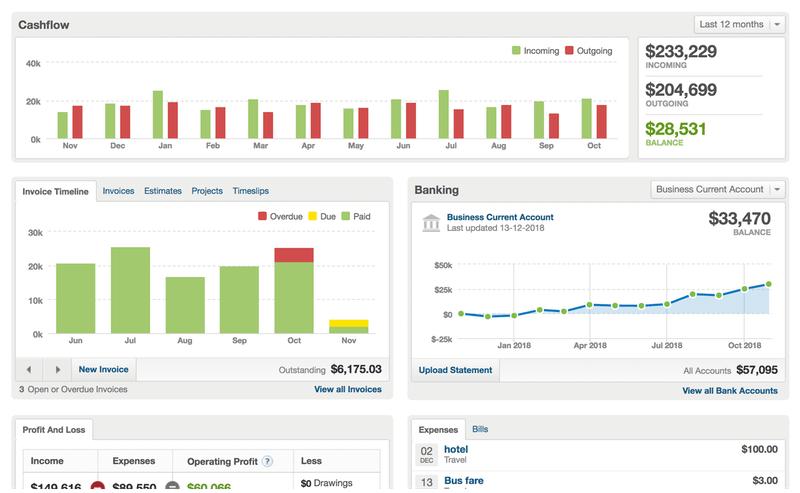

FreshBooks is a very simple and user-friendly accounting solution available in four pricing packages which only differ in the amount of clients you can add to your contact list. During the 30-day trial, you will get unlimited access to the top product, which includes unlimited invoices, expenses, projects, a clever time tracking add-on, auto-generated business reports, a stellar and complete iOS and Android app, integration with 38 third-party apps and access to the quick and outstanding customer support. It should be noted that the fast payment option is charged with an additional fee of 2.9% + $0.30 per transaction.

What Is The Best Software For Bookkeeping

Sage One

Creating Quotes in Sage One

Sales Report in Sage One

Sage has been on the market since 1981, but now we focus on its online solution, Sage One. This software has only one pricing plan, thus you get the fully functional software during the 30-day trial: 7 languages, unlimited invoicing, quoting, billing, tracking your incomes and expenses, auto-categorization of your transactions, a clever forecasting of your future cashflow, 18 business reports, and access from PC, Mac, iOS and Android devices. However, you can only integrate 22 apps and to fully access the help center or the webinars, learning materials and tutorials, you have to create a separate account.

Optional cookies and other technologies

What Is The Best Bookkeeping Software For Mac

We use analytics cookies to ensure you get the best experience on our website. You can decline analytics cookies and navigate our website, however cookies must be consented to and enabled prior to using the FreshBooks platform. To learn about how we use your data, please Read our Privacy Policy. Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. You may disable these by changing your browser settings, but this may affect how the website functions.

Small Business Software Mac

To learn more about how we use your data, please read our Privacy Statement.